Here is a question: If you invested $10,000 in a fund in December of 2021 where the marketing materials stated:

“Investors are expected to receive cash flows from two sources: ~5% of annualized income from property rents, which is expected to be paid quarterly, and the balance of the returns are expected to be achieved via appreciation at time of sale of the properties, which is anticipated to be within 5 years”

but you recieved $0 in payments as of March 2024, would you consider this investment to be “Performing”?

Harbor Group Multi-Family Eq Portfolio II – Q3 2023

Your investment in Harbor Group Multi-Family Eq Portfolio II continues to perform.

This is the claim by Yieldstreet in investment after investment. They present this to investors with quarterly reports and with a classification system. “Your investment in _________ is performing”. The underline represents the name of the fund, of which there have been at least 10 in this category for longer than 2 years.

In common English language it should be obvious that the investment is not performing. Specific expectations were given in the marketing materials and those expectations aren’t being met. It makes it extremely simple when it can’t be argued some theoretical payments are close to the targetted percentage because there are zero payments.

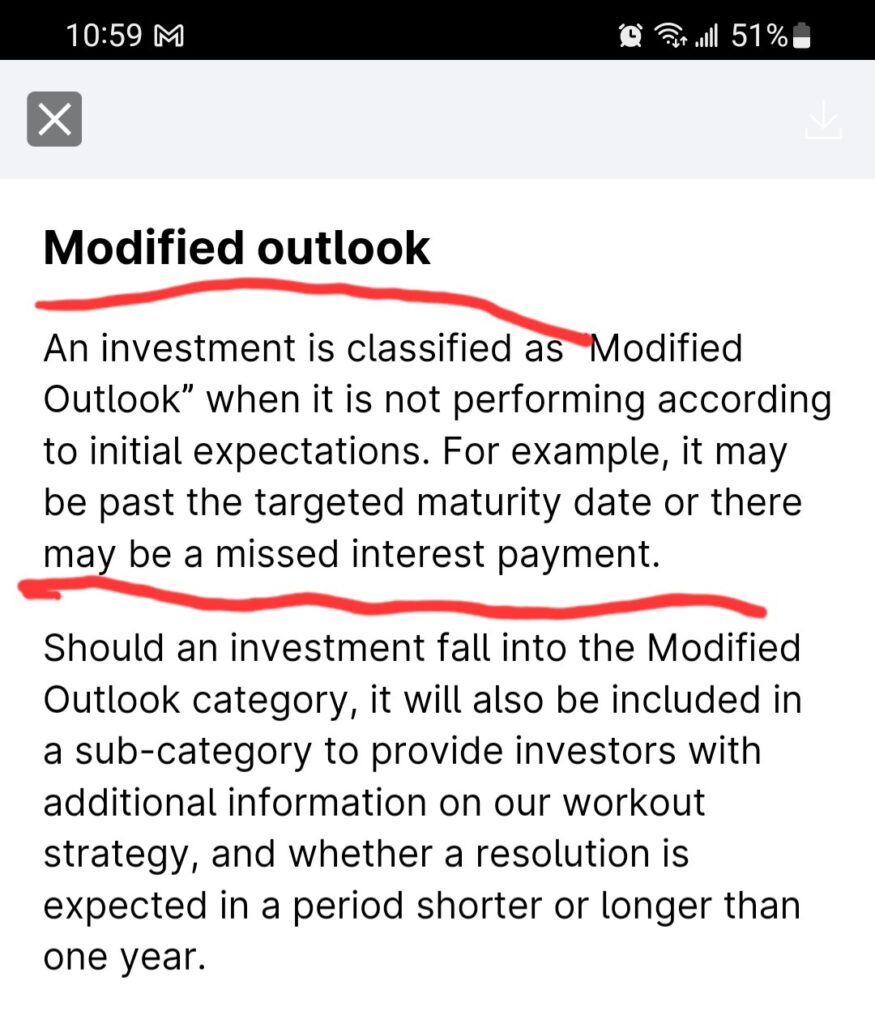

But perhaps there is an “Official’ definition of the word performing which Yieldstreet might be using to somehow justify their claim? However, in Yieldstreet’s own documentation they categorize investments which are “Modified Outlook” (a rather minimization of the word “Underperforming” or “Not Performing”) but it still exists on their website which states that a missed payment does re-categorize the investment.

* As of April 2024 YieldStreet has modified some of the language in the investor portal to no longer classify investments as “Performing” and simply refer to all investments which are specfically not on their “watchlist” as “active”. However, they still appear to be using the false claim that investments are “Performing” in the quarterly reports for funds that make zero distributions.